Login

Signup

EITC Program

- Home -

- Eitc Program

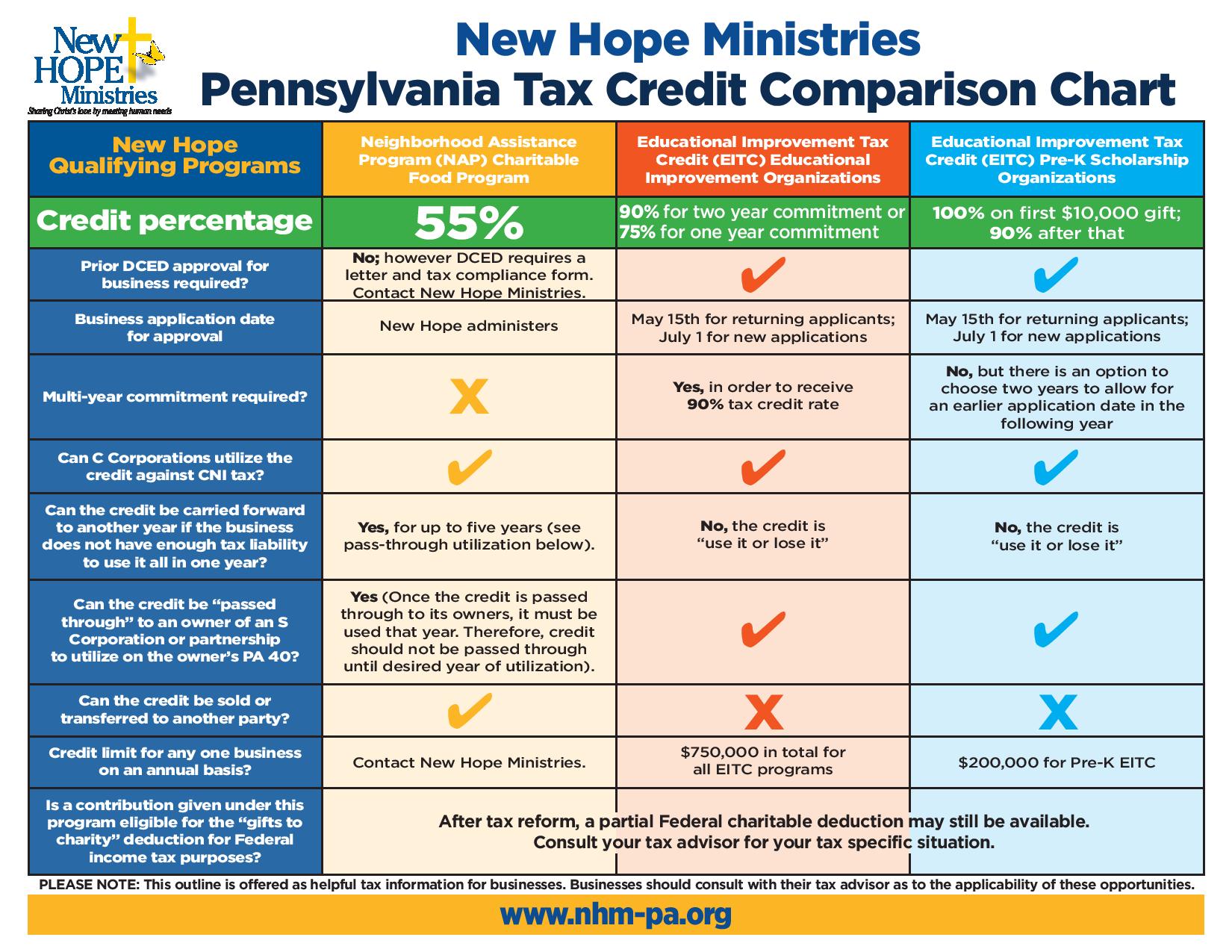

New Hope Ministries can receive Educational Improvement Tax Credit (EITC) donations from approved businesses for the following programs:

Education Improvement Organization (EIO) for our Dual Enrollment Scholarship Program to offer low-income high school students tuition assistance to earn college credit while still in high school

Pre-Kindergarten Scholarship Organization for our Pre-K Scholarship Program to offer income-eligible families direct tuition assistance for enrollment of children in high-quality pre-kindergarten programs

EITC is administered by the Department of Community and Economic Development (DCED) under Act 48 and awards tax credits to businesses that make contributions to scholarship organizations and/or educational improvement organizations that are on a list approved and published by DCED. Click the links to locate New Hope’s listing as an approved EIO and Pre-K organization.

Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made.

Eligible businesses are those authorized to do business in Pennsylvania who are subject to one or more of the following taxes:

- Personal Income Tax

- Capital Stock/Foreign Franchise Tax

- Corporate Net Income Tax

- Bank Shares Tax

- Title Insurance & Trust Company Shares Tax

- Insurance Premium Tax (excluding surplus lines, unauthorized, domestic/foreign marine)

- Mutual Thrift Tax

- Malt Beverage Tax

- Retaliatory Fees under section 212 of the Insurance Company Law of 1921

Tax credits equal to 75 percent of its contribution up to a maximum of $750,000 per taxable year. Can be increased to 90 percent of the contribution, if business agrees to provide same amount for two consecutive tax years. For contributions to Pre-Kindergarten Scholarship Organizations, a business may receive a tax credit equal to 100 percent of the first $10,000 contributed and up to 90 percent of the remaining amount contributed up to a maximum credit of $200,000 annually.

EITC Business Application Guide

EITC Business Guidelines and Applications

To learn more about the EITC program for businesses, please visit the DCED EITC website.

Applications must be submitted electronically using DCED’s Single Application for Assistance weblink.

For more information about EITC or New Hope’s approved programs, please contact:

Molly Helmstetter, Director of Development, 717-432-2087, ext. 203

Joel Giovannetti, Northern Tier Gift Officer, 717-432-2087 ext. 204

Gene Hagenberger, Southern Tier Gift Officer, 717-432-2087 ext. 206