NAP (Neighborhood Assistance Program)

Did you know??

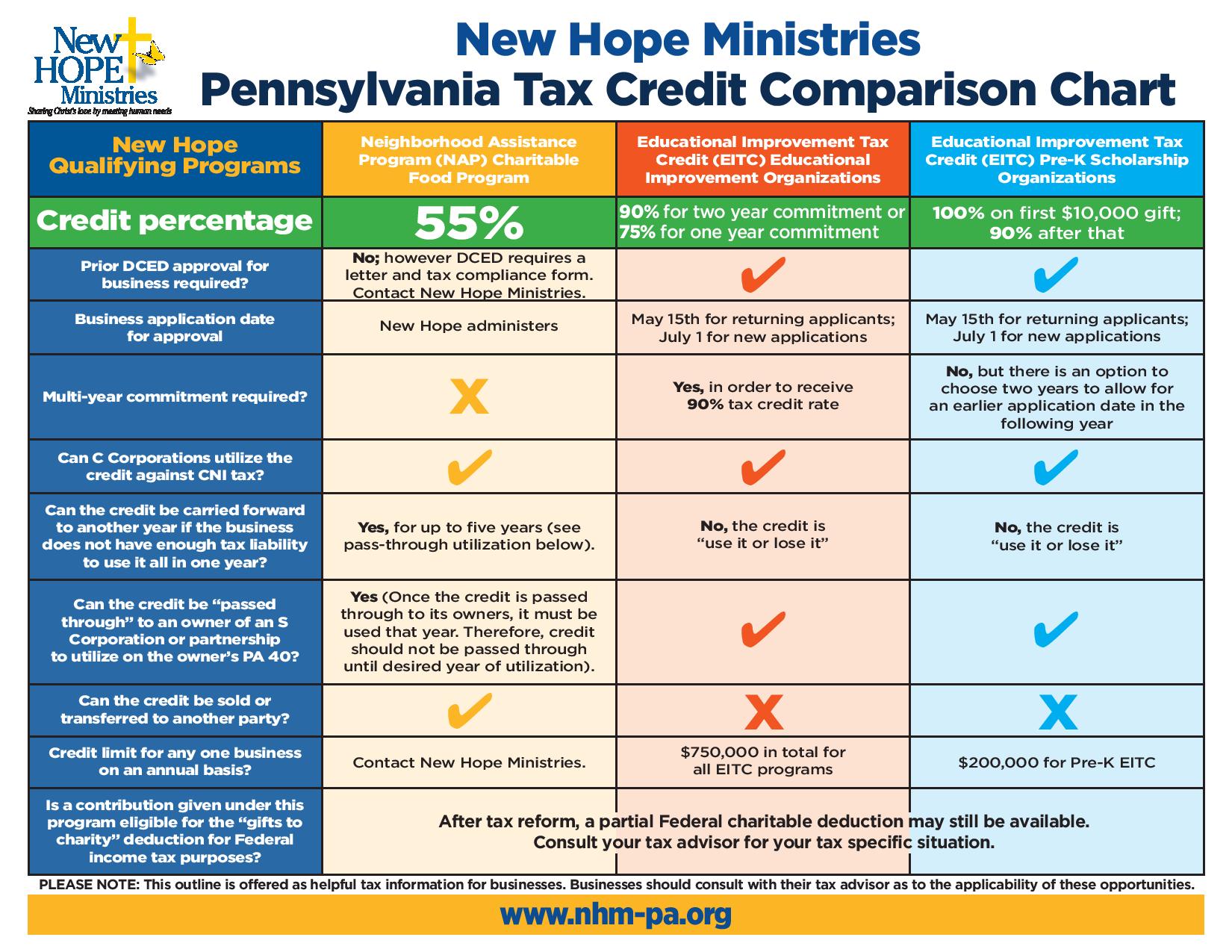

NAP tax credits are available to qualifying Pennsylvania businesses and offer credits worth 55% of business donations for approved projects. New Hope has been a long time beneficiary of the NAP program for our Charitable Food Program (CFP). Generous gifts from businesses like yours could help us raise needed funding to put food on the table for families that are in need.

Visit the DCED NAP website for more details on this program, where you can download the guidelines and appropriate forms.

Click here to download a sample letter of commitment form (PDF). (FY 2024-2025)

Click here to be directed to the ONLINE Revenue Clearance Form businesses complete after they send a letter of commitment to New Hope Ministries.